College Savings & Pre-Paid Tuition Plan

Texas Guaranteed Tuition Plan (TGTP)

Formerly known as Texas Tomorrow Fund, if you plan to pay using a TGTP, you will need to provide a copy of your TGTP ID card to Outside_Awards@baylor.edu.

Private College 529 Plan

Do the rising costs of higher education have you concerned? With Private College 529 PlanSM, your student's dreams of attending Baylor University may be closer than you think.

How It Works

Private College 529 PlanSM is a Prepaid Tuition Plan. You have the opportunity to purchase "tuition certificates" at today's rates, instead of waiting until your student is of college age. These tuition certificates may be redeemed at Baylor University or at more than 296 other private colleges and universities across the nation. Even an account opened as late as your student's freshman year of college can result in real savings and tuition certificates may be used for up to 30 years.

Why Private College 529 PlanSM?

- Higher education is a worthy investment.

- It's also a safe investment, not subject to the swings of financial markets.

- Tuition certificates are redeemable at a large and growing network of private colleges and universities up to 30 years after they are purchased.

Actual Savings

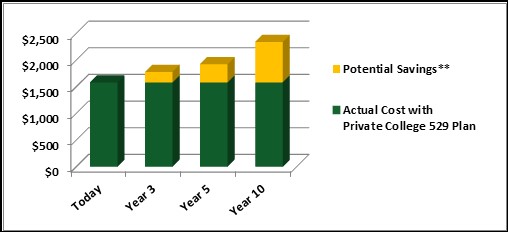

With the cost of higher education on the rise, one credit hour purchased in seven years could cost over 30% more than the same credit hour costs today. What if you could save that money and use it to pay for room, meals, and books instead? In ten years, one credit hour could easily cost 50% more than it does today.

The graph below illustrates how savings on the cost of a credit hour could add up if tuition continues to increase at just 4% per year.

*Tuition certificates must be held for at least 36 months before redemption.

What if my student decides not to attend Baylor?

Private College 529 PlanSM tuition certificates are redeemable at more than 296 private colleges and universities. Of course, participation in Private College 529 PlanSM does not guarantee or influence a student's admission to any college or university.

You may also do the following:

- Change the beneficiary

- Roll the account into another 529 Plan

- Request a refund**

**There may be tax consequences associated with this option. Please see PrivateCollege529.com for additional details.

How can I learn more or enroll in the Plan?

For complete details about Private College 529 PlanSM, including a comparison with other college saving options, a complete list of participating colleges and universities, and easy online enrollment, click here or call 1-888-718-7878. You can begin investing in your student's future today by contributing as little as $25/month.